What are the best states to retire in?

Finance

35. Hawaii

Bobak Ha'Eri/Wikimedia Commons

When it comes time to retire, some seniors opt to move to a new state for their next chapters. They might do this for lower costs of living, better healthcare, and friendlier tax laws.

We ranked 30 states from the highest cost of living to the lowest, with data on tax breaks, annual income, and healthcare costs. These were taken from Kiplinger, Milken Institute, National Association of Realtors, Bureau of Labor Statistics and more. Did your home state make the list?

Cost of living: 87 percent above U.S. average

Population: 1.4 million

Best city: Maunawili

PRO: The best city for retirees in this tropical state is Maunawili on the island of O?ahu, says Niche.com. It’s home to popular hiking destinations and close to the state capital, Honolulu. Hawaii, in general, is full of nature and water sports.

Frank Schulenburg/Wikimedia Commons

CON: The cost of living is pretty high in Hawaii — 87 percent above average. That’s even higher than the other sunshine state, California. The average income for 65 plus individuals is over $71K, says Kiplinger. Few in its population meet U.S. poverty guidelines.

NEXT: This state was named after a U.S. president.

34. Washington

Cost of living: 21 percent above U.S. average

Population: 7.1 million

Best city: Vancouver

PRO: Washington, in general, isn’t the cheapest place to live, but those craving the Pacific Northwest lifestyle at budget prices might head to Vancouver. There, retirees will find more affordability and the lack of a state income tax.

Roman Eugeniusz/Wikimedia Commons

CON: Its cost of living is 21 percent above the national average, that’s less than California and Hawaii, but still might be an obstacle for some seniors. The average income for households 65 plus is over $55K, which might help balance your budget out.

NEXT: Back in Revolutionary War days, this was the first state to declare independence from England.

33. New Hampshire

Cost of living: 18 percent above the U.S. average

Population: 1.3 million

Best city: Gilford

PRO: It’s quite tax friendly in New Hampshire, says Kiplinger, as it doesn’t tax any retirement income. For those with lots of healthcare needs, the state ranks fifth for senior health, according to the United Health Foundation. An added benefit: its picturesque New England landscapes.

Dennis Jarvis/Wikimedia Commons

CON: You gotta pay up for those breathtaking landscapes, though! New Hampshire’s cost of living is pretty high compared to the national average, but it might work itself out considering the tax situation. There’s also the cold winters and humid summers to consider.

NEXT: The state has more “ghost towns” than any other state.

32. Oregon

Cost of living: 18 percent above U.S. average

Population: 4 million

Best city: Gold Beach

PRO: Healthcare costs for a retired couple are usually 2.6 percent lower than the nation’s average. For the outdoorsy senior, there’s lots of nature to enjoy. Just make sure you don’t mind the rain! You’ll get plenty during the eight-month rainy season.

Yurivict/Wikimedia Commons

CON: Oregon isn’t tax-friendly. Social Security is exempt, but most retirement income isn’t and Oregon has one of the highest state income taxes in the U.S. at 9.9 percent. Also, income for seniors is pretty low, with an average of just over $45K.

NEXT: Edgar Allan Poe, poet of mystery and macabre, is from here.

31. Maryland

Cost of living: 17 percent above U.S. average

Population: 6.0 million

Best city: Chevy Chase Village

PRO: Its average household income for folks 65 plus is the second highest in the U.S., on average about $70,874. Nice! Maryland is home to big city Baltimore and very close to the sights of Washington D.C.

Art Anderson/Wikimedia Commons

CON: True, individuals do make more money here than the rest of the U.S., but this income gets taxed heavily in Maryland. Social Security isn’t taxed, but distributions from individual retirement accounts are. There’s also an estate and inheritance tax.

NEXT: This state is home to the U.S.’s flagship Olympic Training Center.

30. Colorado

Cost of living: 17 percent above U.S. average

Population: 5.4 million

Best city: Colorado Springs

PRO: Colorado ranks fourth in the United Health Foundation’s senior health rankings. It also has low rates of obesity and physical inactivity in its senior populations. Perhaps, those in the Centennial State will also live to be 100?

Roman Eugeniusz/Wikimedia Commons

CON: If you want to buy a house in Colorado, be wary because the market is very competitive in places like Denver. The state’s high altitude will take some adjusting to, but then you’ll probably enjoy the pleasant weather.

NEXT: The “first Thanksgiving” was apparently held here, predating the Plymouth feast by two years.

29. Virginia

Cost of living: 7 percent above U.S. average

Population: 8.3 million

Best city: Roanoke

PRO: Cost of living is more than the national average but it should balance out as incomes are high in Virginia. Healthcare, a big concern for most retirees, is generally inexpensive. In addition, Social Security isn’t taxed and residents 65 plus can deduct $12K of their income.

Kevin Boniface/Wikimedia Commons

CON: Seniors in poverty might struggle with the above average living costs. There are a lot of cool cities to check out in Virginia like Richmond, Roanoke, and Lexington, but they’re not big cities like Los Angeles or New York City. Head elsewhere for big city living.

NEXT: Jell-O became this state’s official food.

28. Utah

Cost of living: 4 percent above U.S. average

Population: 2.9 million

Best city: Salt Lake City

PRO: Utah’s healthcare ranks second for seniors in the U.S. according to the United Health Foundation. There are also plenty of outdoor activities to take advantage of with five national parks, five national forests, and 43 state parks.

Cookiecaper/Wikimedia Commons

CON: Utah isn’t that tax-friendly to retirees. It taxes Social Security, which might hurt seniors already in poverty. The Beehive State has the third-lowest poverty rate in the country for seniors. Its income levels are at the U.S.’s average, which won’t help struggling retirees.

NEXT: This state’s name in Spanish means “snow-capped.”

27. Nevada

Cost of living: 4 percent above U.S. average

Population: 2.8 million

Best city: Winchester

PRO: This state has some sweet deals on taxes, for instance, no state income tax! Poverty rates for seniors are also pretty low (8.4 percent compared with the U.S. average of 9.4 percent). It’s also home to Vegas, baby!

Thomas Wolf/Wikimedia Commons

CON: The cost of living is a little bit over the nation’s average and temperatures can be extreme, ranging from 50 to 120 degrees Fahrenheit. Nevada’s year-round semi-arid desert climate might make it the driest state in the U.S. That might be good for folks with allergies, however.

NEXT: Rice cakes were created in this state.

26. Minnesota

Cost of living: 4 percent above U.S. average

Population: 5.5 million

Best city: Osseo

PRO: This state is a good place for health-focused retirees. The United Health Foundation ranked it as the “healthiest in the country for seniors.” It’s also home to the renowned Mayo Clinic in Rochester, Minnesota. If you have complex health issues, this might be a good choice for you.

Bobak Ha’Eri/Wikimedia Commons

CON: It’s got the not so great combination of higher than average cost of living and below average annual income. Minnesota also taxes Social Security as much as the Feds do. Other retirement incomes aren’t free from taxation either.

NEXT: The bolo tie is the “official neckwear” of this Southwestern state.

25. Arizona

Cost of living: 3 percent above U.S. average

Population: 6.7 million

Best city: Green Valley

PRO: The Grand Canyon State has lots of sunshine and beautiful desert landscape, making it a popular retirement destination for those sick of icy winters. It’s easier to retire in than states like California or New York with its three percent above U.S. national average cost of living.

James Brooks/Wikimedia Commons

CON: Arizona’s dry heat makes it almost unbearable during summertime, with temperatures in some localities reaching between 104 and 107 degrees Fahrenheit. It’s not the cheapest to live in with average household income for seniors 10.8 percent below national average.

NEXT: This state has the largest city in the contiguous 48 states.

24. Florida

Cost of living: 1 percent above U.S. average

Population: 19.9 million

Best city: Jacksonville

PRO: Here’s probably one of the most tax-friendly states in the United States. Perhaps this, along with its endless sunshine, is why Florida has the highest share of seniors in the U.S. Its benefits are also very fiscally secure.

J. Miers/Wikimedia Commons

CON: Weather in Florida can turn nasty. Heat and humidity can be a nuisance, and even dangerous to seniors with poor health. There’s also the danger of hurricanes and intense thunder and lightning storms. Other than hurricane weather, it’s pleasant and warm mostly…

NEXT: Donut holes were invented in this state. Delicious!

23. Maine

Cost of living: 2 percent below the U.S. average

Population: 1.3 million

Best city: Portland

PRO: If you’re a fan of lobster, you don’t have to look far to get the good stuff. Both cost of living and healthcare costs are below the national average, which is good for retirees living off retirement income and savings.

Paul VanDerWerf/Wikimedia Commons

CON: The tax situation in Maine is just OK — most retirement income is taxable. However, Social Security isn’t taxed and estate tax only applies to estates worth $11.8 million and above. Income levels aren’t high, says Kipling. Senior households make 25.2 percent below the national average.

NEXT: Social Security, pensions and retirement account withdrawals from its state income tax are exempt in this state.

22. Pennsylvania

Cost of living: 3 percent below U.S. average

Population: 12.8 million

Best city: Pittsburgh

PRO: Forbes named Pittsburgh as the best city in the U.S. to retire in. It has a high number of doctors per capita and is very walkable and bikeable. Pennsylvania, in general, is good to retirees with inexpensive healthcare and tax breaks.

Derek Jensen/Wikimedia Commons

CON: Pennsylvania isn’t sturdy in its own budget, making its future questionable. Financially unsound states (for example, Kansas) might raise taxes, which could affect senior citizens. George Mason University rates Pennsylvania’s fiscal health at 45 out of all 50 states.

NEXT: The official bird of this state’s capital is the plastic lawn flamingo.

21. Wisconsin

Cost of living: 4 percent below U.S. average

Population: 5.8 million

Best city: Madison

PRO: Cost of living is low and there are some tax breaks for low-income residents’ retirement income. Cheese lovers will love being in proximity to some of the best cheese in the nation, as well as cheese curds. Yum!

Dori/Wikimedia Commons

CON: Wisconsin isn’t very tax friendly and has the lowest household income for people 65 and older in the nation. Although Social Security is exempt, other retirement income is subject to taxation. The icing on the cake: Healthcare costs are higher than the U.S. average.

NEXT: This state is home to the largest bottle of ketchup.

20. Illinois

Cost of living: 4 percent below U.S. average

Population: 12.9 million

Best city: Leland Grove

PRO: Illinois’ fiscal standing has been declining for a while. On the up hand, that means its cost of living is below the national average possibly making it pretty affordable for some retirees. Suburban town, Leland Grove, is ranked as the best place in Illinois to retire in according to Niche.

Nikopoley/Wikimedia Commons

CON: However, its fiscal standing has put Illinois in the second-lowest ranking for fiscal soundness. Tax breaks on a variety of retirement incomes aren’t assured and there are high sales taxes.

NEXT: Most of the mainstream population knows this state for its potatoes.

19. Idaho

Cost of living: 5 percent below the U.S. average

Population: 1.6 million

Best city: Sandpoint

PRO: Nature lovers will enjoy the various environments in Idaho — the rugged landscape, snow-capped mountains, lakes, and canyons. Its cost of living allows retirees to really stretch their dollar and live thrifty Golden Years.

USDA/Wikimedia Commons

CON: Those craving big city livin’ will not have a great time in Idaho. You’ll need to go to a more metropolitan area for that kind of life style! Its tax-friendliness is a mixed bag for seniors: state tax is six percent and state income tax is over seven percent. However Social Security isn’t taxed and there’s no inheritance or estate tax.

NEXT: The local economy is strong in this state’s best city for retirees, making it a great place for retirement work.

18. North Carolina

Cost of living: 5 percent below U.S. average

Population: 9.9 million

Best city: Asheville

PRO: North Carolina usually has fairly mild weather year-round compared with most of the country. It’s very lush and green, great for nature lovers. Most costs of living are pretty low, save for the Kill Devil Hills area, and Social Security isn’t taxed.

eurimaco/Wikimedia Commons

CON: Although costs of living are low, income levels are also low at an average of $43,616 for folks 65 years and older. Social Security isn’t taxed but other retirement income is taxable at a flat rate of 5.9 percent.

NEXT: The first Civil War battle took place in this state.

17. South Carolina

Cost of living: 7 percent below U.S. average

Population: 4.8 million

Best city: Bluffton

PRO: South Carolina has mild weather almost all year-round, making it an attractive retirement destination. Another draw? Its affordability, with cost of living 7 percent below the national average. With taxes being friendly to retirement incomes, you should be riding easy.

David R. Tribble/Wikimedia Commons

CON: Summers get pretty hot and humid in this Southern state, although most of the time weather is pretty mild. Health isn’t the best in South Carolina with high obesity levels, many smokers, and low consumption of veggies.

NEXT: A rare, Civil War-era, double-barreled cannon is on display in the city hall of this state’s best city for retirement.

16. Georgia

Cost of living: 7 percent below U.S. average

Population: 10.1 million

Best city: Athens

PRO: Georgia has two things most people like: low living costs and warm weather. Healthcare is also inexpensive for retirees (sixth lowest costs for couples in the nation). Its low state taxes are also very appealing for budget-conscious retirees.

Cassie Wright for Terry College of Business/Wikimedia Commons

CON: If you’re keen on Southern living, make sure you’re ready for Georgia’s long, hot and humid summers. Most people avoid the outdoors around noon because it’s way too sticky. An added nuisance: All the mosquitos!

NEXT: The first public university in Thomas Jefferson’s Louisiana Purchase Territory is located in this state.

15. Missouri

Cost of living: 10 percent below U.S. average

Population: 6.1 million

Best city: Columbia

PRO: Missouri’s low costs of living are very appealing for retirees — 10 percent below the nation’s average. Bookworms will also nerd out about all the famous writers from the “Show Me State” like Maya Angelou, Mark Twain, T.S. Eliot, and more.

Library of Congress/Wikimedia Commons

CON: It’s cheap to live in Missouri but that doesn’t help too much as household income levels are also pretty low (for 65 plus persons, it’s a little over $43K). Its tax situation is mixed and it has poor healthcare for seniors.

NEXT: This state’s best city for retirement has a seriously low crime rate.

14. Texas

Cost of living: 10 percent below U.S. average

Population: 27.0 million

Best city: San Marcos

PRO: Living costs are below the nation’s average and average income for folks 65 years of age and older isn’t bad. Incomes aren’t taxed heavily in Texas, so your dollar can stretch even further. There are cool cities, as well, like Austin and Dallas.

Leaflet/Wikimedia Commons

CON: Overall, Texas is affordable except for its healthcare, a strong consideration for most retirees. Texas is high in poverty, unfortunately, with the sixth highest senior poverty rate in the U.S. at 10.8 percent.

NEXT: A chef from this state is responsible for the monstrosity the “turducken” — a three bird roll-up Thanksgiving dish.

13. Louisiana

Cost of living: 10 percent below U.S. average

Population: 4.6 million

Best city: Baton Rouge

PRO: Louisiana has low costs of living and lots of sights and activities to keep active seniors busy. There are the music and tourist attractions of New Orleans and Baton Rouge, famous cuisine, and natural wonders like the swamps. You won’t be at a loss for adventures here!

davidpinter/Wikimedia Commons

CON: Living costs might be low, but so are incomes. The average for people 65 years and older is $50,744. That might make it hard to afford things like healthcare, which are 2.1 percent over the U.S. average costs.

NEXT: This state was the birthplace of Kool-Aid in 1927.

12. Nebraska

Cost of living: 12 percent below the U.S. average

Population: 1.9 million

Best city: O’Neill

PRO: Retirees will enjoy a very low cost of living in addition to a state with good fiscal health. (The Mercatus Center at George Mason University ranks Nebraska sixth in that category.) The city of O’Neill got an “A” for retiree living from Niche.com.

Bmanishreddy123/Wikimedia Commons

CON: Cost of living is low, but it’s not very tax friendly to seniors. Most retirement income is taxable, unfortunately. Social Security is only exempt if you make $43,000 or less for single filers, $58,000 for joint filers

NEXT: The most visited national park is in this state.

11. Tennessee

Cost of living: 12 percent below U.S. average

Population: 6.5 million

Best city: Lookout Mountain

PRO: Tennessee is tax-friendly to retirees. It doesn’t levy state income taxes so your retirement income can stretch further. All metro areas are very affordable in all senses, even healthcare which is usually a big concern for seniors.

Kaldari/Wikimedia Commons

CON: Summertime can be unbearable, sometimes reaching 92 degrees Fahrenheit in July. Add some humidity, and the summer months might seem even hotter. Traffic isn’t great in Tennessee, especially around bigger cities Nashville and Memphis. Going out of town will require planning and patience.

NEXT: The first traffic light in the U.S. was installed in this state.

10. Ohio

Cost of living: 12 percent below U.S. average

Population: 11.6 million

Best city: Bellbrook

PRO: Geographically, Ohio’s central location makes it easy to travel to either coast to visit family and friends or go on vacation. Cost of living is quite low at 12 percent below the nation’s average and Social Security isn’t taxed.

Cleveland84/Wikimedia Commons

CON: Low costs of living and exempt Social Security is appealing, but its average household income for senior citizens isn’t that high. Ohio might work out for you if you have a lot of savings, otherwise, you’ll have to deal with the average income at $42,667.

NEXT: This state celebrates “Log Cabin Day” every Sunday in June.

9. Michigan

Cost of living: 12 percent below U.S. average

Population: 9.9 million

Best city: Farmington

PRO: Its low cost of living and low poverty rate make Michigan very appealing to retirees. Also, Social Security isn’t taxed out here in the Great Lakes state. For those into water sports, the Great Lakes will make for a fun destination during Michigan’s spring and summer months.

Mikerussell/Wikimedia Commons

CON: Michigan is going to have a complicated tax situation in a few years. Come 2020, folks 67 plus must choose between deducting Social Security income or $20K of all income sources for singles, $40K for couples.

NEXT: The house in the famous painting American Gothic by Grant Wood is in this state.

8. Iowa

Cost of living: 12 percent below U.S. average

Population: 3.1 million

Best city: Iowa City

PRO: Yay! No state income tax on Social Security earnings and a state income tax break for pension income! Iowa City is designated as a “City of Literature” by UNESCO and is home to a vibrant cultural scene and famous university.

Vkulikov/Wikimedia Commons

CON: Taxes aren’t easy on seniors’ wallets in Iowa, despite Social Security benefits being untaxed. Retirement income might be hit by up to 8.98 percent. However, people 55 and up can exclude up to $6,000 of taxable retirement income.

NEXT: This state introduced Mardi Gras to the Western World.

7. Alabama

Cost of living: 13 percent below U.S. average

Population: 4.8 million

Best city: Orange Beach

PRO: Head down to the Heart of Dixie where it’s budget-friendly. Most spend 4.4 percent less than the average retired couple on healthcare, income taxes are from 2 to 5 percent, and Social Security benefits are exempt.

Charles Lowry/Wikimedia Commons

CON: Storms can get intense during spring and November, with lots of rain and thunderstorms. Like most Southern states, Alabama will be hot, hot, hot during the summer. When picking a place to live, consider how southern Alabama is warmer than the North.

NEXT: A ball of twine weighing 16,750 pounds is located in this state.

6. Kansas

Cost of living: 14 percent below average

Population: 2.9 million

Best city: Eureka

PRO: Cost of living is pretty low in the Sunflower State, which might convince you that there’s no place like home in Kansas (get it? Wizard of Oz reference?). Its scenic plains and prairies are also appealing to any nature lovers out there.

Kansas City District U.S. Army Corps of Engineers – Turtles/Wikimedia Commons

CON: Kansas isn’t in the best financial shape so it’s raising taxes to rectify its budget deficit. Most retirement incomes, including Social Security, will be subject to state taxes with rates from 3.1 to 5.7 percent. Might not be the best place if you’re very budget conscious.

NEXT: The “Horse Capital of the World” is in this state.

5. Kentucky

Cost of living: 14 percent below average

Population: 4.4 million

Best city: Lexington

PRO: Welcome to the Bluegrass State, where retirees can enjoy low living costs and a high number of tax breaks. Social Security and $41,110 of other income are exempt from taxes. However, it’s not the healthiest place for senior folks…

Russell and Sydney Poore/Wikimedia Commons

CON: Senior health costs aren’t cheaper than other states — it’s about at the U.S. average. It also ranks badly in senior health, with high rates of smoking, physical inactivity, and poverty. There’s also a low number of good nursing homes to care for seniors.

NEXT: Root beer was invented in this state.

4. Mississippi

Cost of living: 15 below U.S. average

Population: 3.0 million

Best city: Hide-A-Way Lake

PRO: Seniors might like Mississippi’s sweet tax breaks and low costs on everyday items. All of your Social Security, distributions from IRAs and 401Ks, and other retirement incomes won’t be subject to taxes. Also, those property taxes are the lowest in the country.

Allstarecho/Wikimedia Commons

CON: While Mississippi taxes and living costs are easy on the wallet, the state ranks last for senior health according to the United Health Foundation. It also has the worst poverty rate in the country for seniors — 13.4 percent.

NEXT: Abraham Lincoln lived in this state when he was a child.

3. Indiana

Cost of living: 15 percent below U.S. average

Population: 6.6 million

Best city: Meridian Hills

PRO: Indiana’s cost of living is 15 percent below the national average, meaning everyday expenses like food, housing, gas, etc, are much more affordable. These things would take a hit on your wallet in places like California and Hawaii.

Diego Delso/Wikimedia Commons

CON: The state of Indiana is best for seniors with lots of savings as its annual income is below the U.S. average (21.4 percent below to be exact) and retirement income, other than Social Security, is taxable at ordinary rates.

NEXT: Voicemail was patented by a man from this state.

2. Oklahoma

Cost of living: 16 percent below U.S. average

Population: 3.9 million

Best city: Nichols Hills

PRO: Low costs of living will most benefit those that have lots of retirement savings. Oklahoma is also one of the states that doesn’t tax Social Security and up to $10K can be excluded from retirement income. This helps considering average incomes are low.

Kool Cats Photography over 9 Million Views/Wikimedia Commons

CON: Oklahoma ranks third-worst for senior health. Not only are there high levels of physical inactivity and smoking, but there’s also a lack of geriatric care and good nursing homes available to treat all the health problems.

NEXT: The first woman elected to the U.S. Senate, Hattie Ophelia Caraway, was from this state.

1. Arkansas

Cost of living: 17 percent below U.S. average

Population: 3.0 million

Best city: Bella Vista

PRO: Quite a low cost of living in the Natural State, as well as average health costs being the third lowest for retired couples. Arkansas is known for its wildlife, hot springs, mountains, and rivers — hence the name the “Natural State.”

USDA Natural Resources Conservation Service/Wikimedia Commons

CON: Arkansas’ state taxes aren’t that easy on the wallet. Social Security benefits and up to $6,000 of other retirement income are exempt. Top income tax rates can hit 6.9 percent if the income exceeds $75,000. Poverty rates in Arkansas for seniors are the eighth highest in the U.S. Also, this Southern state isn’t the place to be for those craving big city living!

NEXT: These are the worst states for retirement.

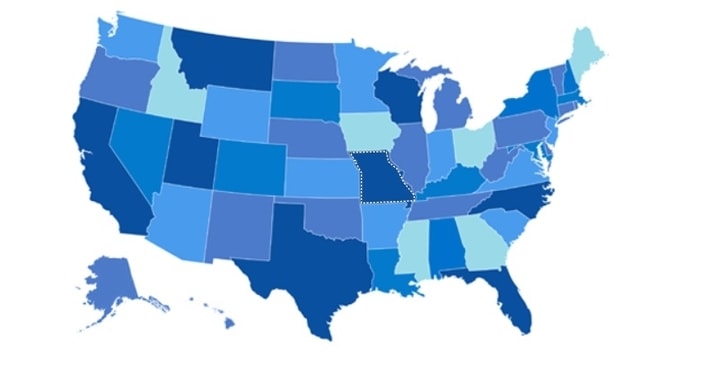

You won’t believe that these are the worst states for retirees

The best states for retirees have a combination of good healthcare options, cheap costs of living, and low taxes. Some states might have great weather or lots to do but make for not great places to live out your Golden Years. According to Kiplinger, these are a handful of states on the West and East Coasts.

TopRetirement.com

Some of these are New York, Massachusetts, Maryland, New Jersey, Connecticut, Rhode Island, and California. California’s cost of living is 52 percent above the U.S. average but Connecticut, Maryland, Massachusetts, Rhode Island, and New York are the least tax-friendly. Save up for retirement if you’re intent on staying in these states!